Yoken

PremiumLast week's price action was bearish and has finally reached the extreme daily demand level and provided some reaction. Price has swept bulls and bears, so now we follow internal structure and wait to see where price actually wants to go. If internal 1h structure breaks bearish, we have confirmation to trade bearish until price goes deeper into the daily extreme zone.

Last week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

Last week's candle was a bearish engulfing meaning that most likely price will continue lower this week as a daily trend retracement. Waiting for LTF bearish price action before entering. Major News: Tuesday - CPI Wednesday - PPI Thursday - Unemployment

Last week pushed bullish and demand is still in control on all time frames, so we are going to follow bullish order flow. Looking for bottom liquidity to be taken in the local range before getting in on a long. Major News: Tuesday - CPI Wednesday - PPI Thursday - Unemployment

EU continues to have clean market structure and has all time frames aligned for bullish movement. Looking for price to retrace to the prime 1h POI for an A+ setup. Major News: FOMC - Wednesday

Last week took the prior week's high and showed large rejection. Expecting this week to take the weak low and liquidity from all the lows to at least the extreme of the daily swing. Major news: FOMC - Wednesday

Price has reached the extreme of daily bearish structure and we can see a rejection of the 4h latest push to make another high. We're following 1h internal bearish structure to at least take out the weak low, thus making 1h structure bearish and following that to the 4h extreme swing low. Major news: Core CPI - Wednesday

Last week swept the high of the prior week and immediately got rejected. We are expecting that the low that swept the high is weak on the HTF and will be following 1h internal structure bearish until the low is at least taken out. Major news: Core CPI - Wednesday

EU 1h and 4h structure are bearish, but there was a large rejection of the daily CHoCH last week leading to large bullish price movement. Our 1h internal structure is bullish, so we will follow that trend for now. Major news: PMI - Monday PMI/ADP NFP - Wed Unemployment Claims - Thurs NFP/Unemployment rate - Friday

A lot of consolidation from the prior week, all time frames are technically bullish and internal 1h structure is bullish. I am going to be cautious around the current level until there is a prime entry model to get in long. Major news: PMI - Monday PMI/ADP NFP - Wed Unemployment Claims - Thurs NFP/Unemployment rate - Friday

Extremely bullish last week leads to my bias being long this week until the weak daily structure is broken. Thanks for coming, goodluck this week! Major News: PMI - Thursday

Bullish previous week leads for my bias being bullish this week as well until price reaches the next Daily supply zone which we will look to trade the pullback. Thanks for stopping by goodluck this week! Major news: PMI - Thursday

All time frames are bearish on EU, looking for a setup at the 4h POI before looking for an entry short. Major News: Unemployment - Thursday

AU is bearish in the short-term until 1h timeframe shifts back to bullish to align with 4h and daily structure. We're looking for shorts in the meantime until price reaches the extreme of the swing structure. Major News: Unemployment - Thursday

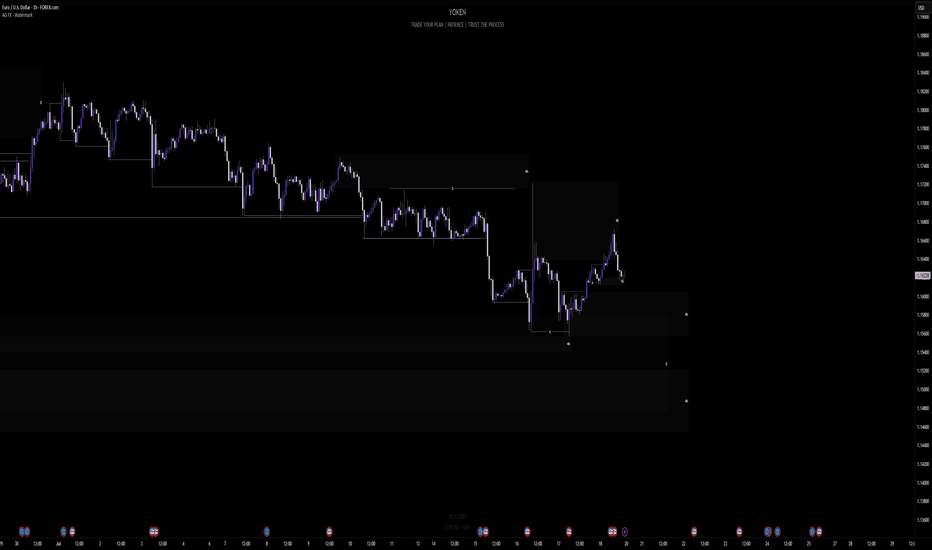

EU has clean structure with Daily, 4h, and 1h bearish. 1h internal structure is bullish at the moment and we're waiting for that to break bearish before looking for any shorts. We're going to be patient and wait for internal before looking for high probability trades. Major news: China trade talks - Monday CPI - Tuesday PPI/Unemployment - Thursday

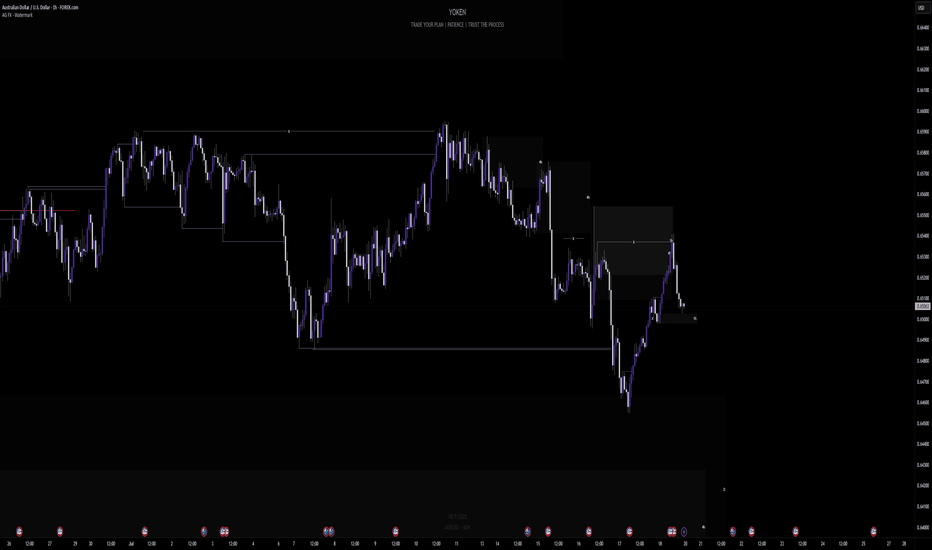

Daily is bullish, so in the future price possibly will trend up. In the meantime 4h and 1h are bearish but has reached a critical daily demand zone at the extreme of daily structure. So far 1h internal is bullish, so we are still looking for longs cautiously until structure is broken. Major news: China trade talks - Monday CPI - Tuesday PPI/Unemployment - Thursday

Eurusd has been consolidating internally, but has made a final push bearish from Friday NFP. We're looking for a short at the flip zone of the 1h POI, but if it goes past that to the extreme of the internal structure, we will be cautious and wait for a break to switch bullish. Thanks for stopping by! Major News: FOMC - Wednesday Unemployment - Thursday

After a hellish week of consolidation, price has made its move higher (finally) and we're back to a trendy chart. My analysis the beginning of the week shows 2 POIs that I am interested in for longs, and if it breaks the level that I pointed out bearish, I will look for shorts. Thanks for tuning in! Major News: FOMC - Wed Unemployment - Thurs